You are here

Objective 1. Secure the supply of blood and blood products

It is the responsibility of the NBA to manage the national blood supply to ensure that healthcare providers have sustainable, reliable and efficient access to blood and blood products needed for patient care. The NBA ensures blood supply security by working with states and territories to determine and manage an annual supply plan and budget, and by negotiating and managing blood supply contracts and arrangements with local and overseas suppliers.

National Supply Plan and Budget

A key element of the NBA's role in ensuring security of supply is to develop, coordinate and monitor the annual National Supply Plan and Budget (NSP&B), including obtaining annual approval from Health Ministers.

This is achieved by:

- developing a national estimate of product demand

- liaising with states and territories to refine the estimated demand for products

- collecting and distributing data on product issued and reporting variations to jurisdictions on the approved supply plan

- intensively managing products if they are in short supply.

Performance against the 2018-19 NSP&B

Throughout 2018-19 products were supplied to meet clinical demand and supply risks were effectively managed. The approved budget for 2018-19 covering the supply and management of blood and blood products and services under contract was $1,259.48 million, comprising $677.23 million for fresh blood products and plasma collection) and $569.2 million for plasma and recombinant products. There is $13.04 million included for items such as support for the publication of PBM Guidelines, maintenance of the Australian Haemophilia Centre Directors' Organisation (AHCDO), administration of the Australian Bleeding Disorders Registry (ABDR), BloodSafe eLearning and the operations of the NBA. Table 2.9 identifies the NBA's expenditure for the supply of products in each product category by supplier in 2018-19 and prior years.

TABLE 2.9 Blood and blood products purchased, by supplier, 2014-15 to 2018-19

| Supplier | Products Purchased | 2014-15 ($M) | 2015-16 ($M) |

2016-17 ($M) | 2017-18 ($M) | 2018-19 ($M) |

|---|---|---|---|---|---|---|

| CSL Behring (Australia) Pty Ltd | Plasma Products

|

245.19 | 282.49 | 351.83 | 376.61 | 397.45 |

| Australian Red Cross Blood Service |

Fresh Blood Products

|

547.10 | 588.40 | 582.40 | 620.69 | 667.94 |

| Shire Australia Pty Limited1 | Imported Plasma and Recombinant Products

|

29.11

|

36.62

|

31.45

|

34.25

|

39.11

|

| Imported IVIg | 40.30 | 28.35 | 0.00 | 0.00 | 0.00 | |

| Bayer Australia Limited | Imported Plasma and Recombinant Products

|

9.00 | 1.07 | 0.00 | 0.00 | 0.00 |

| Pfizer Australia Pty Ltd | Imported Plasma and Recombinant Products

|

54.66 | 56.48 | 56.89 | 49.43 | 37.56 |

| Novo Nordisk Pharmaceuticals Pty Ltd |

Imported Plasma and Recombinant Products

|

32.81 | 36.39 | 24.20 | 35.28 | 35.57 |

| Sanofi-aventis Australia Pty Ltd formerly Bioverativ Australia Pty Ltd | Imported Plasma and Recombinant Products

|

0.00 | 0.00 | 0.00 | 3.68 | 19.72 |

| Octapharma Pty Ltd | Imported IVIg | 70.02 | 47.05 | 0.00 | 0.00 | 0.00 |

| Grifols Australia Pty Ltd | Imported IVIg | 0.00 | 11.58 | 36.30 | 44.72 | 38.70 |

Diagnostic Reagent Products

|

0.41 | 0.36 | 0.33 | 0.37 | 0.38 | |

| Immulab Pty Ltd2 | Diagnostic Reagent Products

|

0.00 | 0.00 | 0.00 | 3.44 | 3.00 |

| Ortho-Clinical Diagnostics Australia Pty Ltd (Johnson & Johnson Medical Pty Ltd) | Diagnostic Reagent Products

|

0.44 | 0.43 | 0.44 | 0.71 | 0.79 |

| Bio-Rad Laboratories Pty Ltd | Diagnostic Reagent Products

|

0.52 | 0.48 | 0.54 | 0.28 | 0.54 |

| Total Purchases of Blood and Blood Products | 1,029.56 | 1,089.70 | 1,084.40 | 1,169.45 | 1,240.77 | |

1 With effect from 4 June 2018, the NBA contracts with Baxalta Australia Pty Ltd were novated to Shire Australia Pty Limited. Throughout this report references are made to Shire Australia Pty Limited.

2 With effect from 26 April 2018, the NBA contract with Seqirus Pty Ltd was novated to Immulab Pty Ltd. Throughout this report references are made to Immulab Pty Ltd.

Fresh blood products

The list of fresh blood products supplied in 2018-19 is at Appendix 2 Fresh blood components supplied under contract by the Blood Service in 2018-19. The four main products were:

- red blood cells

- platelets

- clinical fresh frozen plasma

- plasma for fractionation.

As demonstrated in Table 2.10, the increase in fresh blood expenditure has progressively moderated over the last ten years primarily as a result of improved efficiencies in Blood Service operations, and in the last seven years, a significant reduction in the demand for some fresh blood products due to improved appropriate use and reduced wastage.

TABLE 2.10 Fresh blood expenditure: increases over the last 10 years

| Year | Amount ($M) | Growth (%) |

|---|---|---|

| 2009-10 | 456.1 | 9.3 |

| 2010-11 | 496.6 | 8.9 |

| 2011-12 | 526.3 | 6.0 |

| 2012-13 | 549.3 | 4.4 |

| 2013-14 | 583.1 | 6.2 |

| 2014-15 | 547.1 | -6.2 |

| 2015-16 | 588.4 | 7.5 |

| 2016-17 | 582.4 | -1.0 |

| 2017-18 | 620.7 | 6.6 |

| 2018-19 | 667.9 | 7.6 |

| Total | 5,617.9 | 4.9 (average) |

Fresh blood expenditure in 2018-19 compared to 2017-18 increased by 7.6 per cent. Key factors that have influenced the changes include the following:

- an increase in the quantity of collected plasma for fractionation from 675 tonnes to 736 tonnes

- annual price indexation of 2.95 per cent

- moderation in demand for some fresh products as a result of improved appropriate use and reduced wastage.

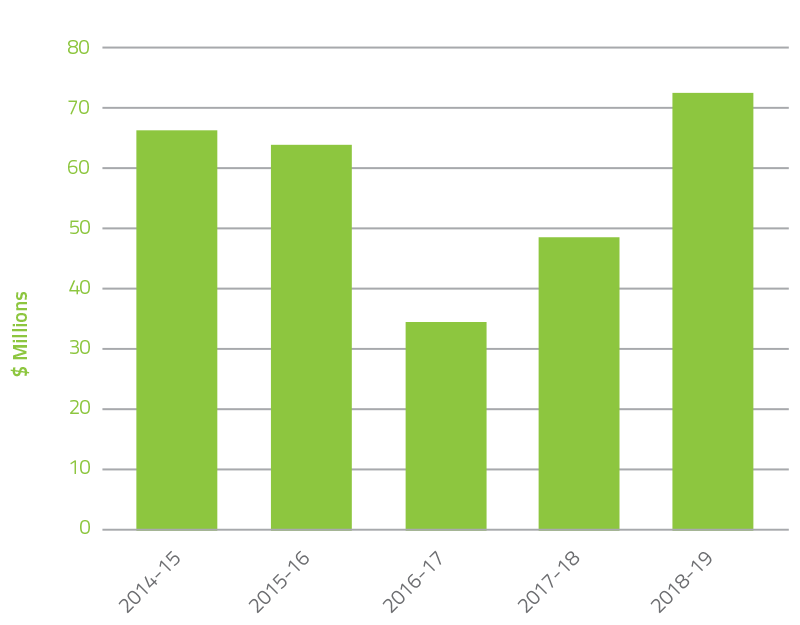

During the last five years, the NBA has seen returns to government year on year as highlighted in Figure 2.1. In 2018-19 $72.2 million was returned including $69.8 million for the Blood Service operating surplus and a saving from the decrease in red blood cell demand of 1.3 per cent against the budget. This compared to $48.5 million in 2017-18 (which included $39.7 million operating surplus and 0.9 per cent decrease in red blood cell demand).

FIGURE 2.1 Returns to government 2014-15 to 2018-19

Red blood cells

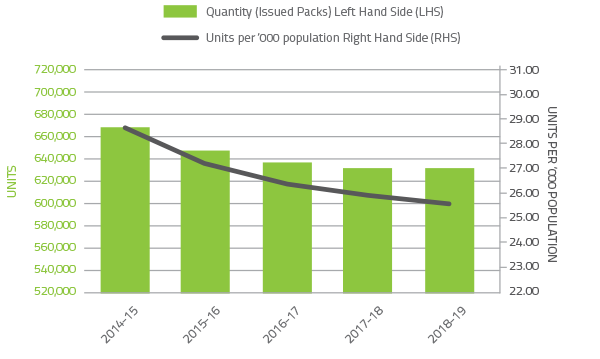

Red blood cells comprise approximately 21.5 per cent of total blood and blood product expenditure and are the second largest item of cost in fresh products behind plasma for fractionation. Figure 2.2 illustrates that there was no change in issues of red blood cells compared to 2017-18, with continuation of the steady decline in issues per 1,000 head of population nationally from 28.3 in 2014-15 to 25.1 in 2018-19. In the last five years, demand for red cells has declined by 6 per cent, realising a saving in excess of $85 million. The decline in red cell demand is the result of the ongoing success of programs to improve appropriate use and reduce wastage. These programs encompass a range of health provider and clinical engagement activities, development of best practice guidelines and tools, improved data collection and analysis and improved education and training arrangements. The publication and implementation of the Patient Blood Management Guidelines underpins much of the success in improving appropriate use of fresh blood products.

FIGURE 2.2 Red Cells issued by the Blood Service 2014-15 to 2018-19 per '000 population

Platelets

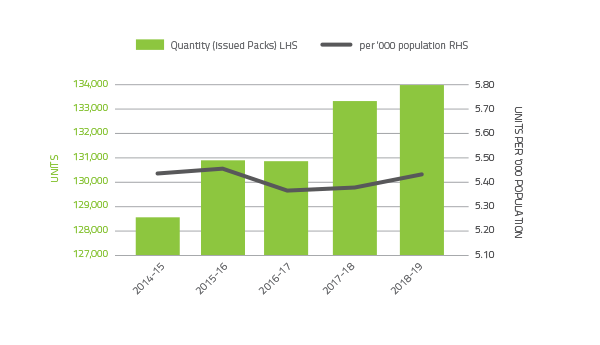

Platelets comprise 4.4 per cent of total blood and blood product expenditure. Figure 2.3 illustrates that there was a 2.6 per cent increase in issues of platelets from 2017-18 and an increase in issues per 1,000 head of population. Platelets are either derived from an apheresis collection or a whole blood collection. In 2018-19 platelets issued were 66 per cent whole blood pooled (70 per cent in 2017-18) and 34 per cent apheresis (30 per cent in 2017-18).

FIGURE 2.3 Platelets issued by the Blood Service 2014-15 to 2018-19 per '000 population

Plasma for fractionation

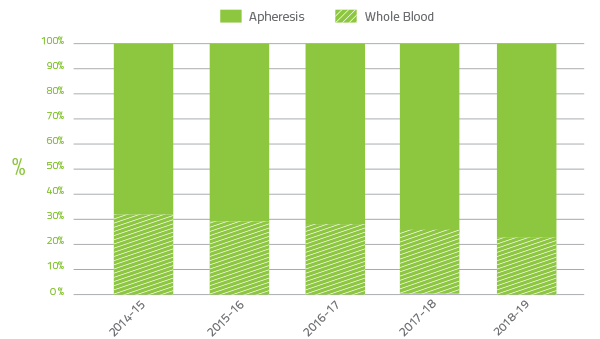

The Blood Service collects plasma for fractionation to supply to CSL Behring (Australia) Pty Ltd for the manufacture of plasma derived products. In 2018-19 the Jurisdictional Blood Committee (JBC) target for the quantity of plasma to be collected by the Blood Service was 695.7 tonnes. The growth in plasma collected by the Blood service in 2018-19 exceeded governments' target by 40 tonnes. The additional plasma for fractionation included 18.5 tonnes of plasma from the two pilot plasma only donor centres. The growth in apheresis plasma collection by the Blood Service over the last five years is shown in Figure 2.4.

In 2014-15 the ratio of whole blood to apheresis plasma for fractionation was 32:68 and in 2018-19 23:77. This is in part due to the decline in red blood cell demand.

FIGURE 2.4 Whole blood to apheresis plasma for fractionation 2014-15 to 2018-19

Plasma and recombinant products

The cost of plasma derived and recombinant blood products issued under NBA arrangements in 2018-19 totalled $571.3 million, an increase of $23.0 million (4.2 per cent) from 2017-18. Decreases in volume and cost for domestic Immunoglobulin (Ig) ($9.0 million or 4.6 per cent overall volume and cost reduction) and Prothrombinex ($1.2 million or 7.9 per cent volume reduction) offset increases in demand for Factor VIII Anti-Inhibitor, recombinant Factor VIII and imported Ig resulting in an increase of $26.9 million from 2017-18. In addition, C1 Esterase increased by $2.9 million.

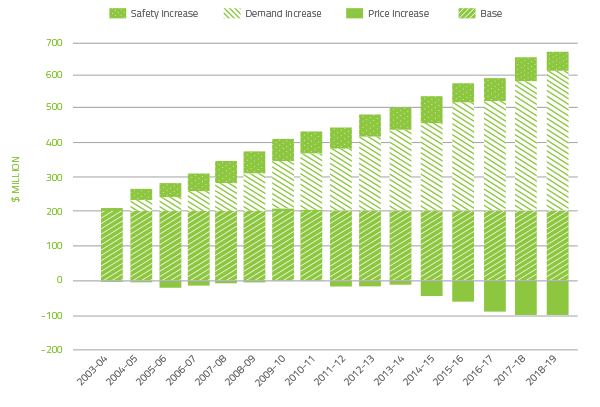

In the 15 years to 2018-19, expenditure on plasma and recombinant products issued under the national blood arrangements has increased from $205.2 million to $571.3 million. Key drivers of this increase are:

- $413.0 million from increased demand

- $51.8 million to fund recombinant clotting factor products (rFVIII and rFIX).

The combined effect of demand and price drivers on expenditure can be seen in Figure 2.5.

It is of note that significant improvements in price have driven a large increase in savings that offsets the increase in demand.

FIGURE 2.5 Plasma derived and overseas product expenditure: cumulative increases on 2003-04 base year

Issues of clotting factors

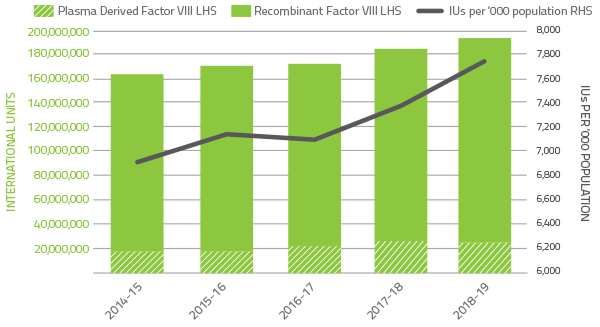

In 2018-19 clotting factors comprised 13.9 per cent of total blood and blood product expenditure. Figure 2.6 indicates that the demand for Factor VIII products increased by 6.7 per cent when compared to 2017-18. The demand for recombinant Factor VIII increased by 8.3 per cent in 2017-18. Plasma derived Factor VIII demand decreased by 3.6 per cent.

The implementation of limited interim arrangements to provide temporary access to Extended Half Life recombinant Factor VIII clotting factor products under the national supply arrangements contributed to the variability of year-to-year growth for these products.

FIGURE 2.6 Issues of Factor VIII products 2014-15 to 2018-19 per '000 population

The demand for Factor IX products in 2018-19 decreased by 12.6 per cent compared to 2017-18 (Figure 2.7). Plasma derived Factor IX demand decreased by 1.3 per cent in 2018-19 due to a reduction in specific patient requirements. Demand for recombinant Factor IX decreased by 12.8 per cent in 2018-19.

The implementation of the limited interim arrangements to provide temporary access to Extended Half Life recombinant Factor IX clotting factor products under the national supply arrangements contributed to the variability of year-to-year growth for these products.

FIGURE 2.7 Issues of Factor IX products 2014-15 to 2018-19 per '000 population

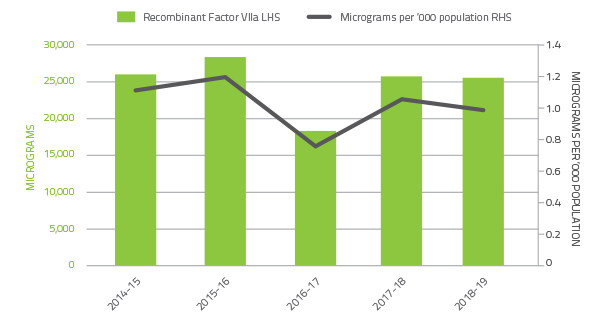

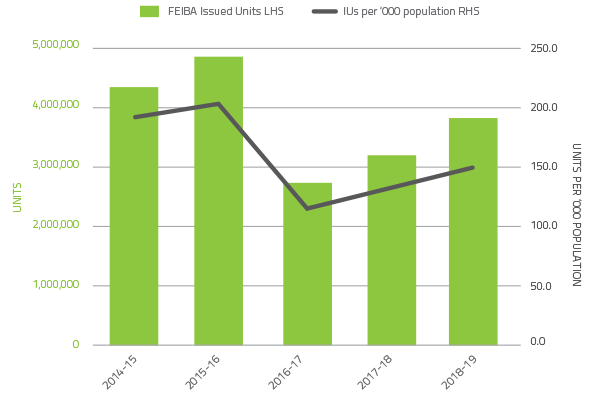

The 2018-19 level of demand for recombinant Factor VIIa decreased by 0.8 per cent and Factor VIII Anti-Inhibitor (FEIBA) decreased by 17.3 percent compared to 2017-18.

Demand for recombinant Factor VIIa and FEIBA can change significantly from year to year as a result of the variable needs of a small number of patients.

These products have also been variable due to ongoing clinical trials in the clotting factor space.

FIGURE 2.8 Issues of Factor VIIa products 2014-15 to 2018-19 per '000 population

FIGURE 2.9 Issues of FEIBA, 2014-15 to 2018-19 per '000 population

Issues of immunoglobulin (Ig)

Demand for Ig was growing at a consistent annual rate of more than 10 per cent up to 2017-18. However, this growth decreased to 7.2 per cent in 2018-19, which is the lowest annual rate of increase since 2004-05 when Australia first secured supply sufficiency through national importation of Ig by the NBA. The National Fractionation Agreement for Australia (NaFAA) with CSL Behring commenced on 1 January 2018, for the continued manufacture and supply of fractionated blood plasma products and delivered savings in 2018-19 of $7.4 million for domestic immunoglobulin.

TABLE 2.11 Immunoglobulin growth

| 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 |

|---|---|---|---|---|

| 10.2% | 12.4% | 11.2% | 10.6% | 7.2% |

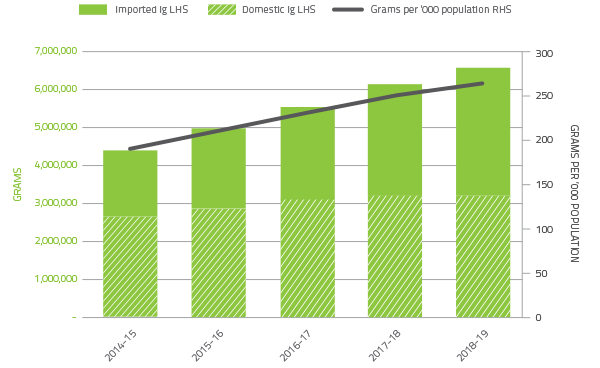

In 2018-19 a total of 6.57 million grams of Ig was issued nationally representing a cost of $613.0 million (including the cost of plasma for fractionation). Of this amount, 48.4 per cent was Ig produced in Australia and 51.6 per cent was imported. Figure 2.10 shows the total growth of Ig per year and the relative proportion of imported Ig compared to domestic Ig.

FIGURE 2.10 Issues of Immunoglobulin products, 2014-15 to 2018-19 per '000 population

Contract Management

The NBA manages contracts with suppliers of blood and blood products to ensure security of supply. Contracts are developed in accordance with the Commonwealth Procurement Rules, and managed in accordance with Best Practice Guidance for contract management, including the guideline from the Department of Finance on Developing and Managing Contracts.

In 2018-19 the NBA managed 15 blood and blood product supply contracts and arrangements.

The contracts managed by the NBA included:

- fresh blood product procurement - Australia's fresh blood component requirements through the Deed of Agreement with the Australian Red Cross Society

- plasma and recombinant product procurement - Australia's plasma product and recombinant product requirements through:

- the National Fractionation Agreement for Australia (NaFAA) with CSL Behring

- contracts for the provision of imported IVIg, imported recombinant factors VIIa, VIII, IX, and XIII, and other imported plasma and recombinant products from commercial suppliers

- red cell diagnostic reagent products.

Deed of Agreement with the Australian Red Cross Society

The Deed of Agreement (Deed) with the Australian Red Cross Society for the supply of fresh blood products by the Blood Service is one of the most important contracts managed by the NBA. The Blood Service is the sole supplier of fresh blood products. The provision of fresh blood products under the Deed is an essential clinical service that saves lives every day. The NBA has an ongoing program with the Blood Service to assure contract performance and accountability under the Deed.

The NBA implemented a nine year Deed with the Australian Red Cross Society on 1 July 2016 and included a three year funding and services agreement. A new three year funding and services agreement was negotiated during 2018-19 and commences on 1 July 2019.

Funding provided to the Blood Service is based on an Output Based Funding Model (OBFM) arrangement agreed by governments. Funding in 2018-19 was $667.9 million, an increase of $47.2 million from 2017-18.

Performance

The performance of the Blood Service is a key element in meeting blood sector objectives. Governments expect the Blood Service to deliver effective services and value for money. Governments outline their expectations of the Blood Service in relation to performance through the Deed and the Blood Service Statement of Expectations. Blood Service performance against selected indicators is outlined in Table 2.12.

TABLE 2.12 Blood Service: selected key performance indicators, 2018-19

| Domain | Indicator | 2017-18 result | 2018-19 Blood Service target | 2018-19 result* | |

|---|---|---|---|---|---|

| Donor management | New donors | Whole Blood | 82,533 | 94,000 (refer note1) | 100,096 (refer note1) |

| Apheresis Plasma2 | 52,333 | ||||

| Supply chain management | Number of days within inventory bands | 365 | 365 | 331 | |

| Red cell yield (proportion of collections converted to supply) | 91.70% | ≥90% | 92% | ||

| Age of red cells at issue (days) | 7.7 | <8.0 | 6.4 | ||

| Order fulfilment red cells | 98.60% | ≥90% | 98.44% | ||

| Quality and level of service | Health provider satisfaction with Blood Service (mean score out of 10) | 9.2 | 9.2 | 9.0 | |

| Finance | Main operating program financial result | $45.2M surplus | $60.9M surplus | $74.8M surplus (refer note3) |

|

* As measured by the Blood Service as at August 2019.

1 The 2018-19 Target and Result combined whole blood and apheresis plasma donors.

2 First time apheresis plasma donor target includes a combination of donors that converted from previously donating whole blood, and new donors as a result of change in 2017-18 that enables donors to donate plasma as their first donation.

3 Result unlikely to change however subject to audit clearance.

Implementing improvements to current arrangements

A number of initiatives were commenced under the Deed during 2018-19, including:

- commencement of an independent external review of the efficiency of the Blood Service, as requested by the Jurisdictional Blood Committee (JBC)

- development of a new Blood Service Statement of Expectations for 2019-22, including updated key performance indicators (KPIs)

- development of the second Funding and Services Agreement covering the period 2019-22, to commence on 1 July 2019

- development of the fourth cycle of the Output Based Funding Model (OBFM) for the period 2019-22, to commence on 1 July 2019.

The NBA and Blood Service data and ICT systems security arrangements continued to be reinforced in response to the Blood Service's data breach incident in 2016. The Blood Service has actioned all recommendations arising from various reviews of the incident. The Office of the Australian Information Commissioner (OAIC) has confirmed in writing that it is satisfied the Blood Service has met the terms of the enforceable undertaking given in response to the 2016 DonateBlood privacy incident. The NBA has agreed with the Blood Service that this matter is now closed.

New technologies and processes continued to be trialled by the Blood Service to improve the efficiency of plasma collection and reduce costs through the continued testing of two pilot plasma only donor collection centres in Townsville and Canberra. The refurbished Townsville centre opened in September 2017 and a new Canberra facility opened in April 2018. In 2018-19 the two centres collected a combined total of 18.5 tonnes of plasma against a forecast of 20.5 tonnes.

The performance and learnings from the two pilot centres will be assessed during 2019-20.

Blood Service research and development

The Blood Service and the NBA have a current Research and Development Framework that was introduced on 1 July 2016. In 2018-19 the Blood Service received grant funding under the Deed of approximately $9.6 million for its research and development program in the following five strategic research areas:

- donor behaviour

- donor health and wellbeing

- product development and storage

- product safety

- product usage.

The Blood Service research and development business outcomes were on track with most of the research projects completed in 2018-19 being translated into changed business practices or learnings.

This year, research and development at the Blood Service remained focused on understanding what motivates current and future donors, the safety and quality of blood components, development of sensitive, specific and cost-effective testing capabilities, enhancement of knowledge of transfusible blood components and their interactions with patients, and improvement of practice. A strong emphasis is placed on translational research through close interaction between the research and development and operational arms of the business through all stages of a research project's life cycle.

National Fractionation Agreement for Australia (NaFAA)

Many of the plasma derived products used in Australia are manufactured under the NaFAA by CSL Behring (Australia) Pty Ltd from plasma collected by the Blood Service. CSL Behring (Australia) Pty Ltd is the sole manufacturer of plasma derived blood products in Australia and the NBA is responsible for negotiating and managing the NaFAA.

The NaFAA came into force on 1 January 2018 and will continue until 31 December 2026, subject to a review in 2022.

In 2018-19, 736.4 tonnes of Australian plasma was pooled for fractionation under the agreements, and expenditure totalled $263.0 million.

Performance

The 2018-19 performance by CSL Behring (Australia) Pty Ltd against the NaFAA key performance indicators (KPIs) is shown in Table 2.13. Sufficient supply of all products was maintained at all times. The performance of CSL Behring (Australia) Pty Ltd was within defined tolerances for each of the KPIs.

TABLE 2.13 CSL Behring (Australia) Pty Ltd's performance under the NaFAA, 2018-19

| Description of performance measure |

Results 2018-19 | |||||

|---|---|---|---|---|---|---|

| Q1 | Q2 | Q3 | Q4 | Annual | ||

| KPI1 | Plasma stewardship | Achieved | Achieved | Achieved | Achieved*# | Achieved |

| KPI2 | Production yield IVIg | 4.780 g/kg | 4.867 g/kg | 4.913 g/kg | 4.828 g/kg | 4.846 g/kg |

| SCIg | N/A | 4.550 g/kg | 4.581 g/kg | 4.318 g/kg | 4.542 g/kg | |

| KPI3 | Management of required inventory levels | |||||

| Minimum starting plasma inventory | Not active in 2018-19 | |||||

| Products in CSL Behring (Australia) Pty Ltd inventory | 100% | 100% | 100% | 100% | 100% | |

| Products in CSL Behring (Australia) Pty Ltd reserve | 100% | 100% | 100% | 100% | 100% | |

| KPI4 | Fulfilment of orders | |||||

| Orders by distributor (Blood Service) and non-distributor |

100% | 100% | 100% | 99% | 100% | |

| KPI5 | Shelf life of national reserve products | 100% | 100% | 100% | 100% | 100% |

Note: Values of less than 100 per cent but greater than 90 per cent are considered to be achieved

*Departed without material effect

#Subject to confirmation

Imported Immunoglobulin (Ig)

Ig is imported to meet the shortfall in domestic Ig production against clinical demand in Australia. In addition to supply under the national blood arrangements, the NBA also supports the purchase of small amounts of obtained imported Ig when necessary through direct orders by individual jurisdictions.

Two contracts are in place for the supply of imported Ig under the national blood arrangements. The contracts commenced in September 2015 and the base term expired on 31 December 2018. The NBA exercised the available extension options and the contracts will expire on 31 December 2020. The suppliers are CSL Behring (Australia) Pty Ltd and Grifols Australia Pty Ltd. In 2018-19 the NBA expended $155.61 million for both contracts.

TENDER FOR FVIII AND FIX

NBA Procurement

The NBA has developed a robust approach to tendering and contracting for blood products, reflecting both the policy objectives of governments under the National Blood Agreement, and the policies and requirements of the Australian Government procurement framework.

The NBA currently manages 15 contracts with suppliers of blood and blood products. Contracts are developed in accordance with the Commonwealth Procurement Rules, and managed in accordance with best practice guidance for contract management, including Best Practice Guidance for contract management, including the guideline from the Department of Finance on Developing and Managing Contracts.

In 2019 the NBA released a tender to establish new national supply arrangements for imported plasma and recombinant products. This includes Standard Half Life (SHL) and Extended Half Life (EHL) rFVIII and rFIX products.

Successful tenderers will be required to supply rFVIII or rFIX products to meet orders from health providers in Australia, maintain contractually required supply security reserves, and provide a range of product support services.

The release of this Request for Tender followed earlier consultation with clinical stakeholders and potential suppliers. Key points identified from the consultation process and other market intelligence are that:

- in general, there is continued support for access to a secure supply of the safest and most efficacious therapies with a preference for EHL products

- the importance of patient access to products with administration devices suitable to all patients with different degrees of dexterity

- a number of potential new product variants including SHL and EHL products, bypassing therapies to treat patients with inhibitors, monoclonal antibodies and gene therapy.

Limited Interim Arrangements for Extended Half Life Clotting Factor Products

In 2018 the NBA implemented limited interim arrangements to provide temporary access to EHL rFVIII and FIX clotting factor products under the national supply arrangements for a limited number of haemophilia A and B patients with high priority needs based on prioritisation criteria.

These arrangements provide rFVIII and FIX products from the supplier companies Shire Australia Pty Limited and Sanofi-aventis Australia Pty Limited (formerly Bioverativ) for approximately two hundred patients, under the coordination and monitoring of the Australian Haemophilia Centre Directors' Organisation (AHCDO) by arrangement with the NBA.

Patients with high priority needs were nominated for participation in the limited interim arrangements by the Directors of the Haemophilia Treatment Centres (HTCs) providing the care for those patients. Decisions about the prioritisation of patients to receive EHL products under the limited interim arrangements are coordinated by AHCDO through its Clinical Advisory Group sub-committee.

Performance

The 2018-19 performance of both CSL Behring (Australia) Pty Ltd and Grifols Australia Pty Ltd against the contractual KPIs is shown in Table 2.14. Sufficient supply of products was maintained to meet demand during the year and was not adversely affected by transient or administrative KPI deviations.

TABLE 2.14 Imported IVIg: key performance indicators, by supplier, 2018-19

| KPI | Performance | CSL Behring (Australia) Pty Ltd | Grifols Australia Pty Ltd |

|---|---|---|---|

| KPI1 | In-country reserve | Achieved | Achieved |

| KPI2 | Shelf life on products delivered | Achieved | Achieved |

| KPI3 | Delivery performance | Achieved | Achieved |

| KPI4 | Reporting accuracy and timeliness | Achieved | Achieved |

In some instances, performance deviated from contracted requirements at some periods during the year and was managed by the NBA.

Imported plasma derived and recombinant blood products

The NBA has contracts with suppliers for the importation of selected plasma derived and recombinant blood products to augment domestic supply where these products are not produced in Australia or domestic production cannot meet demand.

In 2018-19, the NBA managed supply contracts for imported plasma and recombinant products with the following five companies:

- CSL Behring (Australia) Pty Ltd

- Novo Nordisk Pharmaceuticals Pty Ltd

- Pfizer Australia Pty Limited

- Sanofi-aventis Australia Pty Ltd formerly Bioverativ Australia Pty Ltd

- Shire Australia Pty Limited

Expenditure on the above contracts in 2018-19 amounted to $149.49 million.

Performance

The 2018-19 performance of suppliers of imported plasma and recombinant blood products for each performance measure is shown in Table 2.15. All suppliers satisfactorily met required performance levels.

TABLE 2.15 Imported plasma and recombinant blood products: key performance indicators, by supplier, 2018-19

| KPI | Performance measure | Sanofi-aventis Australia Pty Ltd (Alprolix, Eloctate) | CSL Behring (Australia) Pty Ltd (Rhophylac, RiaSTAP, Fibrogammin, Berinert) |

CSL Behring (Australia) Pty Ltd (Factor XI Concentrate) |

Novo Nordisk Pharma-ceuticals Pty Ltd (NovoSeven, NovoThirteen) |

Pfizer Australia Pty Ltd (Xyntha, BeneFIX) |

Shire Australia Pty Limited (FEIBA, Ceprotin) | Shire Australia Pty Limited (Advate, Rixubis, Adynovate) |

|---|---|---|---|---|---|---|---|---|

| KPI1 |

In-country reserve Product Inventory | Achieved | Achieved | Achieved | Achieved | Achieved | Achieved | Achieved |

| KPI2 |

Shelf life on products delivered | Achieved | Achieved | Achieved | Achieved | Achieved | Achieved | Achieved |

| KPI3 |

Delivery performance | Achieved | Achieved | Achieved | Achieved | Achieved | Achieved | Achieved |

| KPI4 | Reporting accuracy and timeliness | Achieved | Not achieved* | Achieved | Achieved | Achieved | Achieved | Not achieved* |

In some instances, performance deviated from contracted requirements at some periods during the year and was managed by the NBA.

* This contract deviation did not adversely impact overall supply during the year.

Red cell diagnostic reagent products

Red cell diagnostic reagents are used for testing to establish the blood group of human red cells, detect red cell antibodies and to control, standardise and validate routine haematology tests.

The NBA has established a standing offer arrangement with the following four suppliers for the period 1 July 2016 to 30 June 2019. The NBA has exercised available extension options extending the term of the standing offer arrangements to 30 June 2021.

- Bio-RAD Laboratories Pty Ltd

- Grifols Australia

- Immulab Pty Ltd

- Ortho-Clinical Diagnostics (Johnson & Johnson Medical Pty Ltd)

The standing offer lists more than 100 red cell diagnostic products, which are used in laboratory tests known as blood typing and cross matching. These tests ensure that when a person needs a blood transfusion, they receive blood that is compatible with their own.

Expenditure on diagnostic reagent supply is capped at $4.85 million per year. The NBA administers the cap for suppliers on behalf of jurisdictions.

Emerging Global Dynamics

The National Blood Agreement requires the National Blood Authority (NBA) "to monitor the national and international environment in which the Australian blood sector operates for new technological, clinical, risk or other developments that may impact on the national blood supply" and requires the NBA "to maintain a systematic approach to identifying new developments, and providing a clearinghouse and coordination function for information in relation to new developments". The framework used to guide this monitoring function is described below.

Our Framework

The NBA monitors international developments which may influence the management of blood and blood products in Australia. Our focus is on:

- information that may have an impact on global supply, demand and pricing, such as changes in company structure, capacity, organisation and ownership

- potential new product developments and applications

- global regulatory and blood practice trends

- other emerging risks that could potentially put financial or other pressures on the Australian sector.

Current areas of interest

- Fresh Blood: transmissible diseases, manufacturing, testing, synthetic blood products, adverse reactions and haemovigilance

- Plasma Products:transmissible diseases, manufacturing, new uses and products, international demand, supply and pricing

- Blood Management: techniques (before, during and after surgery), risk identification, overseas programs and demand management during constrained supply

- Recombinant Products: new uses and products, changes to products, supply, demand and price and adverse reactions

- Policy and Regulation: Australia and overseas

- Logistics

Horizon Scanning

- The NBA maintains constant horizon scanning and intelligence gathering, including from existing and potential suppliers, relevant industry analysts, and communications with comparable organisations in countries including the United Kingdom, Canada and New Zealand.

- The value of international knowledge gained through NBA's engagement on the global

stage translates to a greater understanding

for the local Australian blood sector. In 2018-19 the NBA's Chief Executive and Deputy Chief Executive attended international conferences with the resultant sharing of knowledge with the Australia blood sector.

This places Australia at the forefront of knowledge and understanding.

International engagement

- International Plasma Protein Congress, 19-20 March 2019 – Amsterdam, Netherlands

- Plasma Protein Forum, 18-19 June 2019 – Reston, Virginia, USA

- visits to CSL Behring sites in Switzerland and the USA

- CSL Behring visit, Bern, Switzerland

- visits to Grifols sites in Spain, USA and Canada.

L to R: Mr Markus Weber, Director, IgG & Albumin Bulk Manufacturing, CSL Behring, Mr John Cahill Chief Executive NBA, Ms Sandra Ruckstuhl - Head of Europe Manufacturing Sites Communications CSL Behring at the CSL Behring site in Bern, Switzerland, March 2018.