Intravenous immunoglobulin supply and demand

Since the 1980s, intravenous immunoglobulin (IVIg) has been used to treat an increasing number of conditions. Consequently, the demand for IVIg has greatly increased both internationally and in Australia.

International

Despite fluctuations in demand, the overall worldwide supply of IVIg has increased steadily.

Domestic

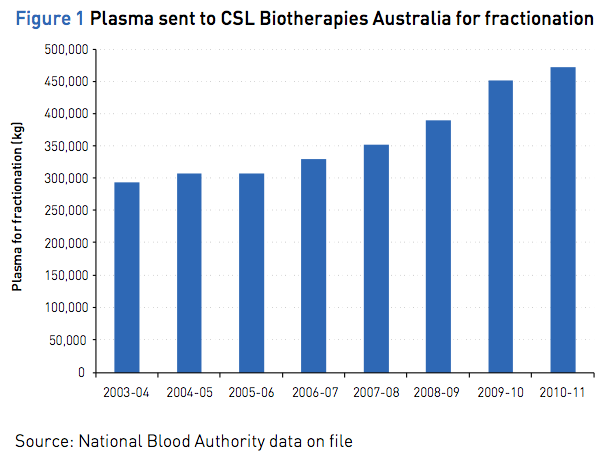

The supply of domestically manufactured IVIg is largely determined by the volume of domestic plasma available for fractionation. The Australian Red Cross Blood Service (the Blood Service) collects plasma from Australian voluntary donors on behalf of all Australian governments. The total amount of plasma collected by the Blood Service over the period from 2003–04 to 2010–11 and sent to CSL Biotherapies Australia for fractionation is shown in Figure 1. CSL Biotherapies Australia is the exclusive manufacturer of IVIg in Australia. All locally produced IVIg is used within Australia.

Complexed chart depicting Plasma sent to CSL Biotherapies Australia for fractionation between 2003/4 and 2010/11. Source: National Blood Authority data on file.

The shortages of IVIg that occurred in the late 1990s stimulated a review of the use of IVIg in Australia by the then Blood and Blood Products Committee of the Australian Health Ministers’ Advisory Council (AHMAC). This review made a number of recommendations relating to the use, distribution and supply targets of IVIg. Clinical guidelines were revised and conditions classified into three groups based on evidence of patient benefit. The report also recommended that the supply of IVIg should be increased through a combination of increasing the amount of plasma collected and enabling the importation of alternative IVIg products. Acting on this, and with the agreement of all governments, the National Blood Authority (NBA) negotiated a standing offer for imported IVIg. This has resulted in imported product being available to meet the supply plans of all jurisdictions and the clinical needs of patients on a more secure basis and at a greatly reduced price compared to previous arrangements.

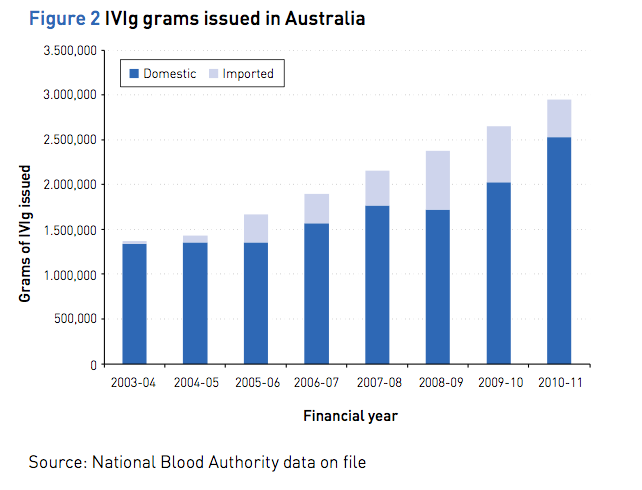

Demand for IVIg has experienced double digit growth between 2006–07 to 2009–10. The annual percentage growth in total grams issued is shown below in Figure 2.

Complexed chart depicting IVIg grams issued in Australia between 2003/4 and 2010/11. Source: National Blood Authority data on file.

Cost of IVIg products

The cost to Australian governments of providing patients with fresh blood products, plasma products and recombinant alternatives in 2010–11 was $967 million. Approximately $149 million of this was spent on IVIg (86% for domestically produced product and 14% for imported product). These are the product costs only and do not include costs associated with the collection of plasma for fractionation.

World trends

Factors that affect the quantities of plasma products required and produced vary with time, but include changes in clinical indications and demographics, the introduction of alternative therapeutics, changes in actual and perceived risks of blood products and modifications to manufacturing processes.

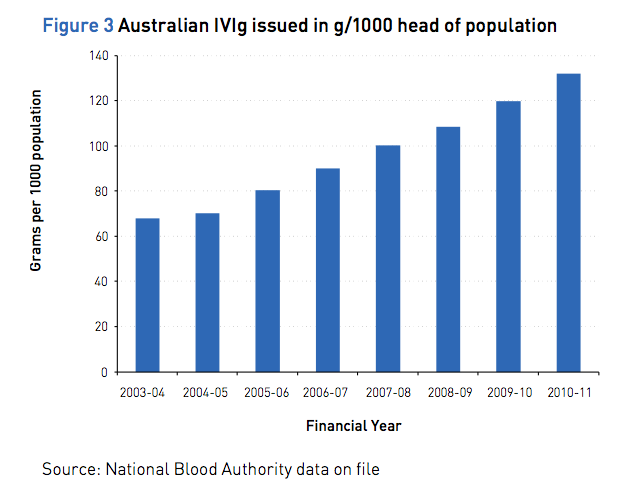

The average annual per capita growth rate for IVIg issued in Australia in the following years before the Criteria was 14% and 10% after the Criteria. The amount of IVIg issued per 1000 head of population is illustrated in Figure 3.

Complexed chart depicting Australian IVIg issued in g/1000 head of population between 2003/4 and 2010/11. Source: National Blood Authority data on file.

In considering the supply and demand of IVIg in Australia over the next decade, considerable effort has been undertaken to analyse both the Australian and international trends presented above.

There is no international consensus on expected growth rates, but the following factors are generally considered important in predicting future growth:

- availability and cost of plasma;

- costs of products and national reimbursement policies;

- development of products that are easier to use;

- development of products that can be administered by other routes (e.g. subcutaneous);

- promotion by the industry;

- availability of clinical studies supporting/not supporting use;

- identification of conditions where a benefit of IVIg is proven or inferred;

- clinical guidelines and authorisation processes; and

- demographics, including the growth of a number of treatable conditions in an ageing population.

How these factors may play out in Australia is difficult to predict with any certainty.

IVIg demand management

A formal review and evaluation of alternative therapies to IVIg has not been undertaken and, as such, specific guidance on the relative efficacy and place in therapy of IVIg in relation to other therapies for each indication cannot be provided.

However, when developing individual treatment plans for patients, clinicians are asked to consider the comparative efficacy, risks and costs associated with IVIg and alternative therapies. Furthermore, clinicians are asked to consider suitable adjuvant therapies that may reduce individual patient requirement for IVIg. These clinical considerations will assist in curtailing the growth in demand for IVIg. For some conditions, the priority of the use of IVIg has been reduced in favour of alternative therapies and is now considered exceptional practice (e.g. the treatment of acute leukaemia in children and HIV in children).